A Tense Coalition, VAT Hike and (R.E.)C.O.N.F.I.G.U.R.A.T.I.O.N

The Budget Debacle bears striking resemblance to the first GNU Parliamentary Meeting and may be more about an attempt to reconfigure the GNU, but if a week is a long time in politics, imagine 30 days.

On 14 June 2024, a meeting was held at the Cape Town International Convention Centre. It was the Inaugural Meeting of the Seventh Parliament, by the end of which the Republic would have an elected Speaker of the National Assembly, Chairperson of the National Council of Provinces, and President of the Republic. As the meeting began, a coalition deal had yet to be finalised. Thus, for the first time in our history, there was no certainty on who would be elected to these high Offices of the State.

Political theatre being what it is, the meeting did not get off without a hitch. However, something fortuitous happened – Floyd Shivambu, then of the EFF, called for a caucus break. This break enabled the negotiators of the two leading parties – the ANC and DA – to iron out some details and strike a deal. The (first) Statement of Intent was signed by the ANC and DA, with that SOI being something akin to an IOU before you sign a Coalition Agreement – there is still no coalition agreement.

Thereafter, as the day proceeded, Members of Parliament voted one by one for Mesdames Thoko Didiza and Refilwe Motsweni-Tsipane to be NA Speaker and NCOP Chair respectively, and one Mr Cyril Ramaphosa to be President – all from the ANC, as agreed. At about 10 pm on 30 June 2024, the President announced a multi-party Extended Cabinet of Ministers and Deputies dominated by the ANC and DA.

We will never know what could have happened if Floyd had not called for that break, but here we are, a little over nine months into a tense forced marriage between the ANC, DA and Many More.

I am reminded of that Caucus break today because we seem to be living through a similar moment. Let me explain.

The Budget (and the 0.5% VAT Hike)

After months of negotiations between parties and in Cabinet, the two main parties are at odds about the Budget and related matters. It is common cause that one of the issues in contention, and which has captured the imagination of the public (and I’d say rightly so), is the 0.5% increase in VAT – effective from 01 May 2025. This is down from the Minister of Finance’s originally planned 2% increase, but it has still caused mild panic and great displeasure amongst the people – again, rightly so.

The passing of the budget is a multi-step process, contrary to what many of us have come to assume. In Parliament, it begins with the adoption of a Fiscal Framework and Revenue Proposals (let’s call it the “Framework”). This is the government’s overarching financial plan for a given period. Next is the adoption of the Division of Revenue as well as the Appropriation Bills. These detail how the budget will be divided between national departments and agencies, provinces and municipalities.

The first step has been concluded. The second is in progress. Nevertheless, an important element to be aware of is that in terms of law, whatever is contained in the Division of Revenue and the Appropriation Bills must be in line with the assumptions, projections and plan contained in the Framework. Consequently, we must take it as a given that the 0.5% VAT hike is here to stay.

Whether we like it or not, the ANC supports the hike. We can also fairly deduce that so do the host of parties who voted to approve the Framework. They did so knowing the hike was one of the assumptions contained therein. If you did not know, they are the IFP, ActionSA, RISE Mzansi, BOSA with Mmusi Maimane, PA, PAC, UDM, Al Jamah-Ah, and GOOD. For what it’s worth, it appears the DA is not opposed and was prepared to live with it if they could secure agreement on reforms that they believe would improve the economy over time, thus potentially minimising its impact. Additionally, they proposed a sunset clause where the hike would be reversed in a few years.

Interestingly, many of the parties who supported the hike say they did so for two main reasons. First, they wanted to prevent a situation where the government would “not have a budget”. Second, they did so on a “strict condition” that the hike would be reversed in “30 days” once the new revenue proposals they would make have been incorporated into the budget. The strict condition, it appears, is that if their wishes are ignored, they will vote against the budget. Let us deal with these.

Firstly, this is South Africa. Ga se mo States mo!

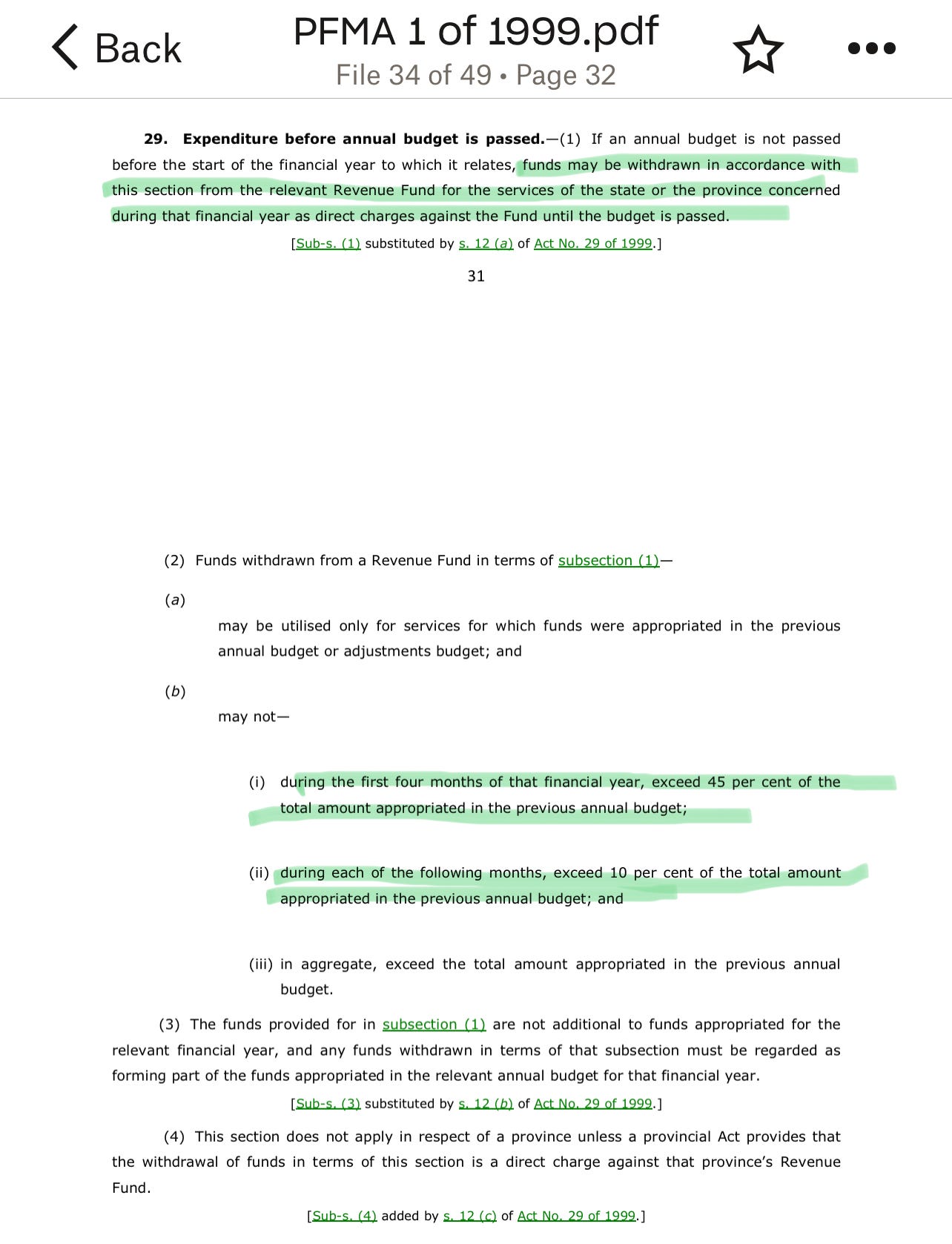

Section 29 of the PFMA was designed to cater for a situation where a new budget had not been approved. It allows the government to spend against the previous year’s budget, with “strict” conditions. Observe:

Second, the opportunity to make new revenue proposals was at the adoption of the Framework. The document is literally called the “Fiscal Framework and Revenue Proposals”. This is where the law allows parties (through their MPs) to make proposals and amendments to whatever the government has proposed. In fact, the law requires MPs to expressly declare whether or not they adopt or amend the Framework.

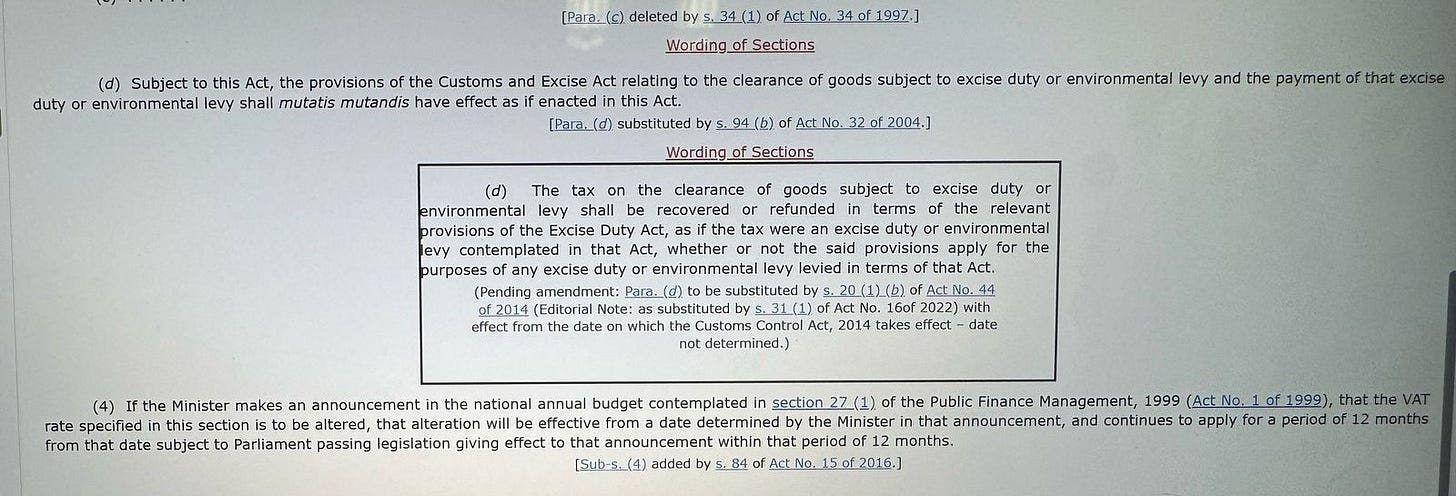

I am not aware of a legal mechanism by which Parliament can realistically amend the Fiscal Framework within 30 days. If any of you super intelligent people do know, please share it with me. What I do know is that the VAT Act requires that if it is to be changed after being announced by the Minister of Finance, such changes can only be made by Parliament passing legislation to do so – a process which takes infinitely longer than 30 days. Observe:

Lastly, many senior government leaders and influential politicians outside government have gone on record saying that it is unlikely to be changed. Perhaps nothing can be more instructive than the leading party itself accepting the VAT hike, and then quickly trying to walk that back. Herewith an excerpt from their statement of 02 April 2025.

On Sunday, the President (wearing his immaculate ANC cardigan) was also pretty clear that it appeared the hike was here to stay, effectively saying National Treasury had already indicated that it appeared there was no alternative.

You can watch the clip here, but he goes on to say that the ANC intended to see out their agreement (with the other parties who supported the VAT hike) to consider alternative revenue proposals. He stops just shy of saying that the ANC and/ or the Minister of Finance reserve(s) the right to reject these alternative proposals. And this, ladies and gentlemen is where it gets a little tricky for those parties.

It is not impossible that when they agreed to pass the Framework as is, they genuinely believed they would be able to stop the VAT hike from going ahead after the fact, but within the 30-day period, and also prevent that imagined “no-budget” crisis.

On the other hand, the ANC and Minister appear to have no such intentions. Someone is being fooled here.

I am reminded that on the day the Framework was passed, someone pointed out to me that it was funny how relatively silent the ANC was about it. Instead, they chose to let other parties who supported it claim the victory and boy did they go to town. I will not explore the wisdom or otherwise (lol) of that approach. We shall temporarily ignore that ANC Chief Whip Mdumiseni Ntuli has since been on a media tour effectively owning the bamboozling of the other parties.

Having dealt with how we arrived here, let us deal with the opportunity.

GNU R.E.C.O.N.F.I.G.U.R.A.T.I.O.N? Maybe. Maybe not.

It seems that some of the parties who voted for the Framework (containing the increased VAT) did so believing the DA overplayed its hand in the budget negotiations and that, having done so, they’ve “defined themselves out of the GNU” and should either leave the government or be kicked out. They believe the DA has an insurmountable likability problem and sought to use the budget debacle to manufacture consent for the DA’s ouster. Additionally, if the DA goes out, those parties would have an opportunity to become part of the government or secure themselves better positions.

The first part is sine qua non for the second. It is the condition without which the other cannot happen. Thus, if the DA is not chucked out, or does not voluntarily leave, the others cannot come in.

This is how we find the similarity with the 14 June 2024 meeting.

Remember step one in the Budget Process? The passing of the Fiscal Framework? Well, it appears there was a missing step in how that step was handled. As I said, the law requires that before Parliament adopts the Framework, the responsible Parliamentary Committees must make a statement expressly stating whether they adopt or amend the framework. It seems this was not done. If so, this is a procedural irregularity which may scupper the whole process and cause it to have to be redone.

Consequently, both the DA and EFF raised this at the Parliamentary meeting that was to adopt the Framework and the DA is now taking this aspect to court. They also raise another novel constitutional point about the Minister’s Section 7(4) power with respect to announcing a binding VAT hike. Observe:

If the matter is heard urgently, and decided in favour of the DA, it could mean that the budget process starts over.

If that happens, whatever differences that still need to be ironed out between the two main parties (and many more) can be attended to and they could find each other. Even if it does not happen – say the DA loses their case – the two parties could still find each other with respect to the other issues not related to VAT that they were negotiating, given the length of time it will still take to finalise the budget process, and then they could support the (rest of the actual) budget Bills in the Steps two and three I detailed above.

We know from the reportage that over the weekend preceding the Framework vote, the ANC and DA were broadly in agreement before the ANC reneged on things previously agreed and then went and found other parties to support the Framework instead, thereby precipitating the collapse of a deal that was close to finalisation. However, it has since been reported that talks between the two have resumed.

If either of the two scenarios occur, the whole house of cards upon which the Many More parties are relying on to maybe join the government immediately collapses.

Alright, that’s it for today. Be back soon and, if no one else has told you, I love you.

SC

-----

And now for the subscription business again…

If you’re enjoying this content, you’re likely finding it valuable and it meets your desires. If you’re already subscribed, thank you so much. I appreciate you to no end. If not, please consider doing so below and share this in your networks. I’d like this content to reach as many eyes as possible. My goal is to help slowly shape the country of our best dreams, together.